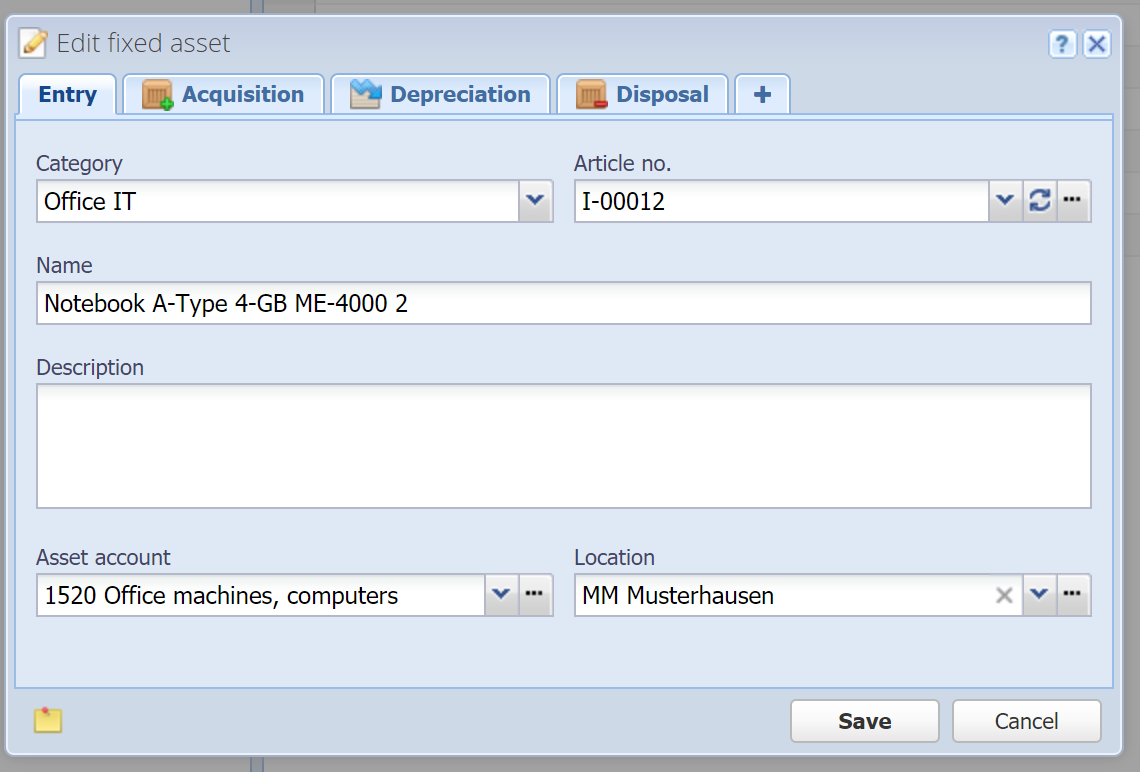

Edit fixed asset

Category

The category in which the fixed asset is created. If you selected a category before clicking "Add" then this field is already filled in. Since categories are optional, this can also be "All fixed assets".

Alternatively, without entering anything, press the down-arrow key or click on the button on the right to display the category tree.

Article no.

Mandatory field

Every fixed asset gets an automatically generated number. This number can also be entered / overridden manually.

In the category you can configure a sequence number that is used for all fixed assets that are created in this category. If no sequence number is set in the category, a default sequence number is used.

Refresh: With this button you can replace the value with the current sequence number.

Refresh: With this button you can replace the value with the current sequence number.

Manage: With this button you can manage the sequence numbers (see Sequence numbers).

Manage: With this button you can manage the sequence numbers (see Sequence numbers).

Name

Mandatory field

Enter the description / name of the fixed asset.

Description

Optional description of the fixed asset.

Asset account

Mandatory field

Choose an account for the fixed asset. Only asset accounts are listed here. Acquisition and depreciations on the fixed asset are booked on this account.

Location

The location of the fixed asset. For example, if you have multiple branch offices you can locate the fixed asset this way.

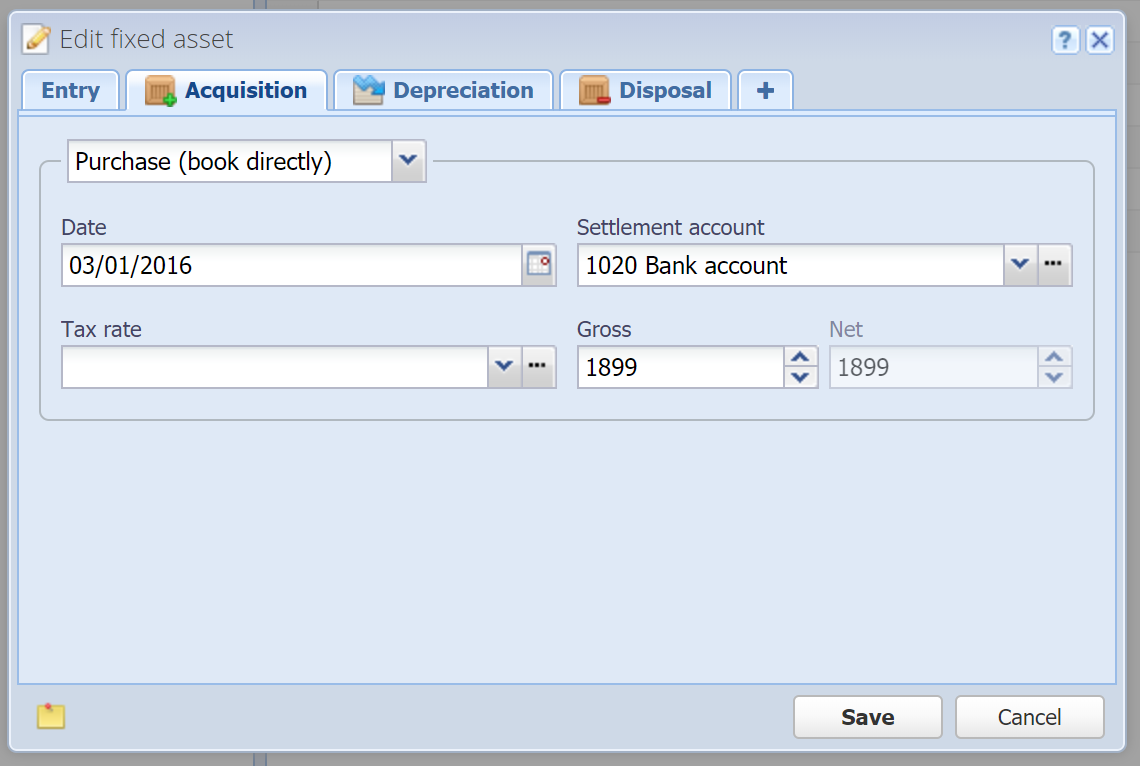

Acquisition

Choose between "Purchase (book directly)" and "Historical (don't book)".

Purchase (book directly)

Date

Mandatory field

The date of the acquisition. More about the date field in general, see Date field.

Purchase price

Mandatory field

Enter the purchase price of the fixed asset.

Allocation account

Mandatory field

Enter the allocation account (e.g. cash or bank account) with which the fixed asset was purchased. The acquisition will be booked on this account.

Historical (don't book)

If you acquired the fixed asset in a past financial year resp. before you switched to CashCtrl, then choose this option. Enter besides the original purchase price also the book value (current value). This will be respected by depreciations.

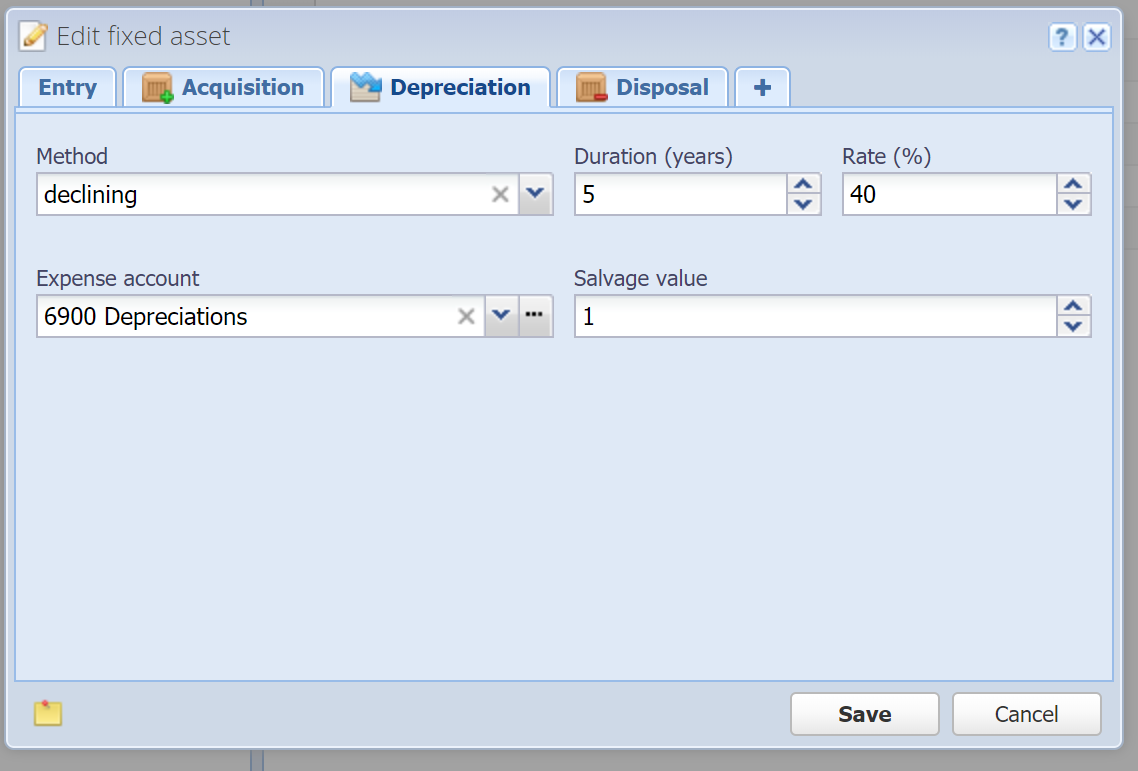

Depreciation

Define the method by which the fixed asset will be depreciated. With this configuration the fixed asset will be depreciated semi-automatically every year (see Complete fiscal period) until the salvage value is reached.

Method

You can choose between 2 depreciation methods: linear or declining. CashCtrl assumes that the rate is double for the declining method. With the linear method the annual depreciation is based on the original purchase price, with the declining method it's based on the last book value each year.

Duration (years)

The duration of the depreciation in years. The minimum value is 1. The rate is automatically calculated from the duration and vice versa.

Rate (%)

Rate of the depreciation as percentage per year. The duration (years) is automatically calculated when entering the rate.

Expense account

The expense account on which the depreciations are booked (e.g. "6900 Depreciations").

Salvage value

Enter the value until which the fixed asset will be depreciated. Depreciations won't go below this value. The fixed asset remains in the inventory with this book value after being fully depreciated until you remove it from your inventory via "Disposal" (see below).

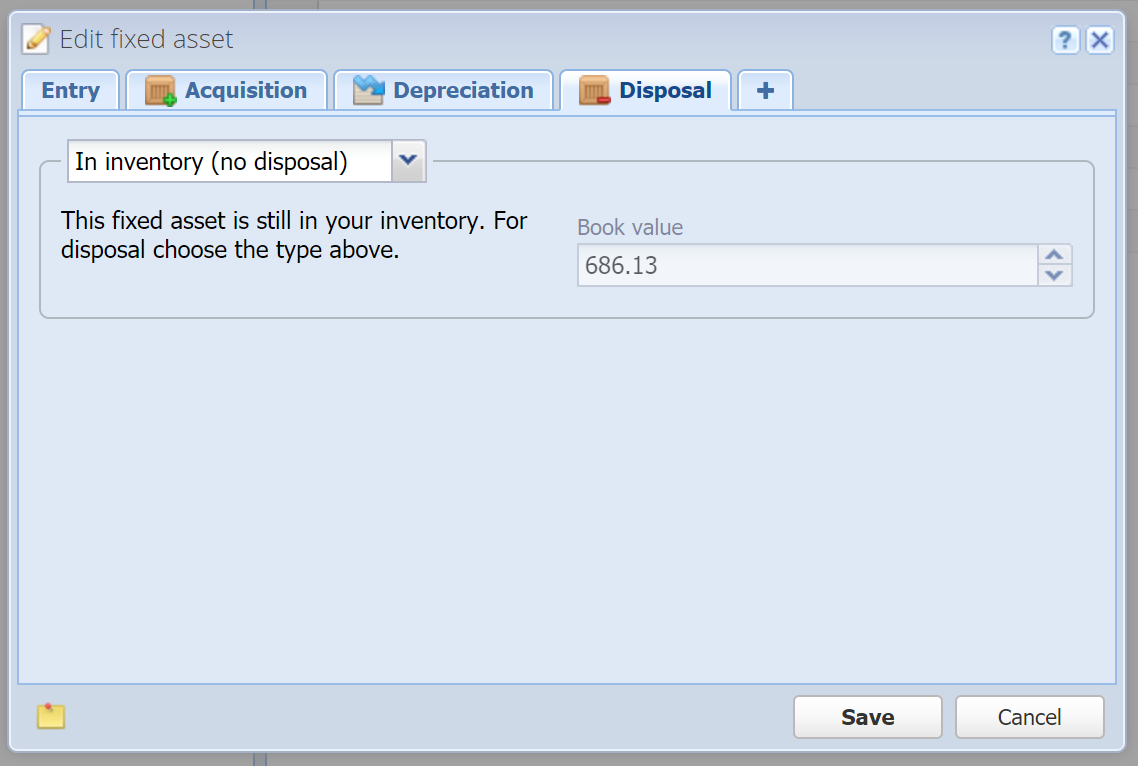

Disposal

Fixed assets are not deleted from the inventory since a book entry is necessary for the disposal of the fixed asset. You can do this here, there are four options:

In inventory (no disposal), Only disposal (no sale), Sale (book directly)

After the disposal of a fixed asset, it will be displayed grayed out in the current financial year. In the next financial year the asset will not be displayed anymore.

In inventory (no disposal)

With this option the fixed asset remains in the inventory, this is the default option.

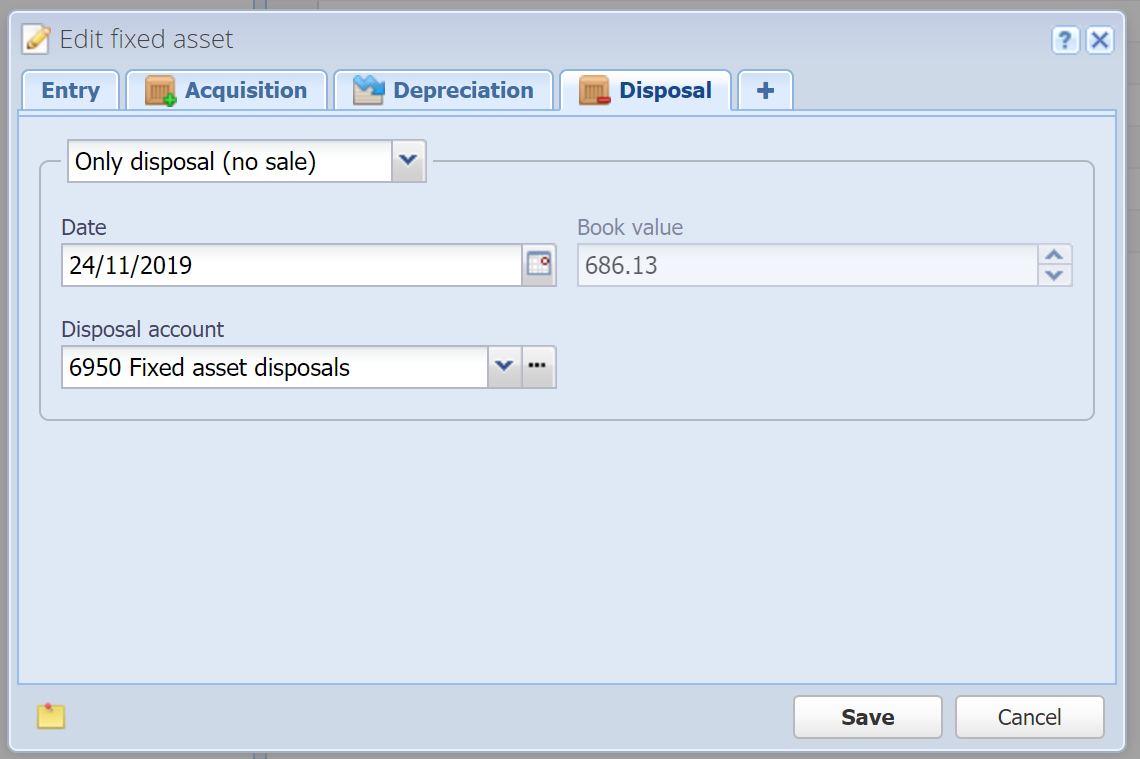

Only disposal (no sale)

Choose this option if you want to dispose of the fixed asset without revenue (e.g. scrap disposal).

Date

Date of the disposal. More about the date field in general, see Date field.

Book value

Displays the current book value of the fixed asset. This value is booked on disposal (subtracted from the asset account).

Disposal account

Choose an expense account for the asset disposal. By default, this would be "6950 Fixed asset disposals".

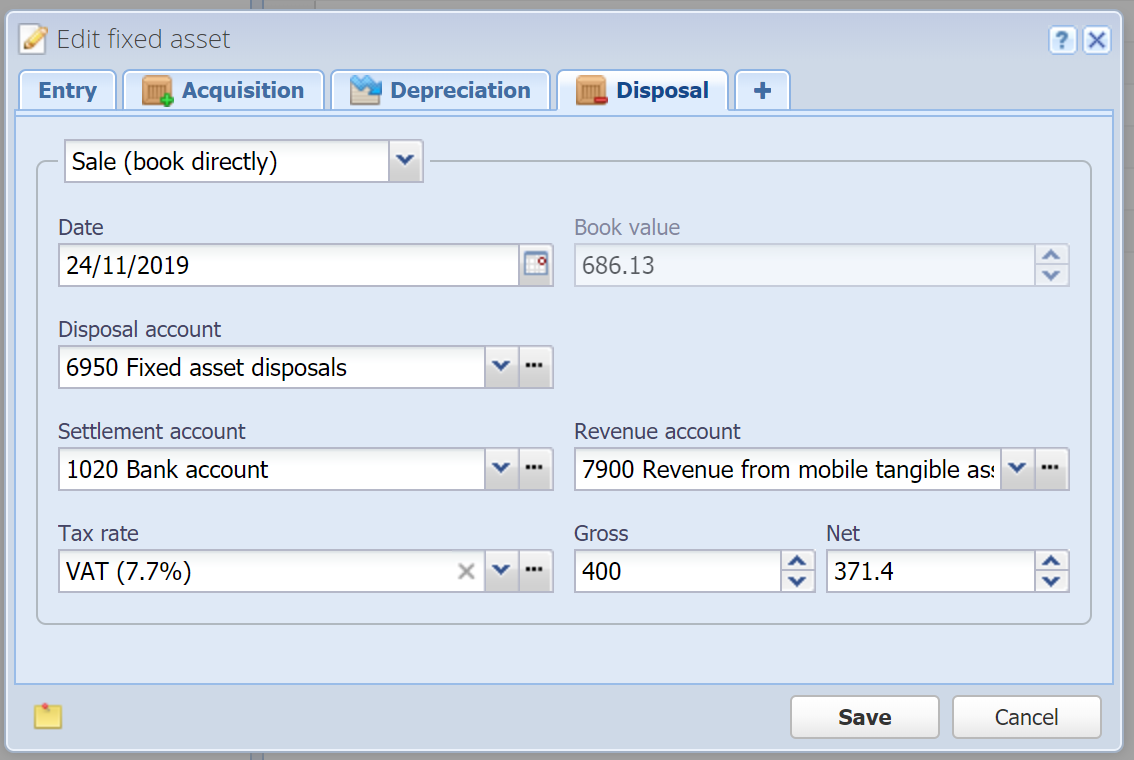

Sale (book directly)

Choose this option if you are selling the fixed asset, but you don't want to create a sales invoice for this. This way the sale is booked directly in the journal.

Date

Date of the disposal. More about the date field in general, see Date field.

Book value

Displays the current book value of the fixed asset. This value is booked on disposal (subtracted from the asset account).

Disposal account

Choose an expense account for the asset disposal. By default, this would be "6950 Fixed asset disposals".

Allocation account

The sale of the fixed asset is charged to this account (e.g. cash register or bank account). Matches the Debit account in the book entry.

Revenue account

The sale of the fixed asset is booked on this revenue account. Matches the Credit account in the book entry.

Tax rate

Tax rate (Sales tax / value-added tax / input tax) which is applied to the book entry.

Gross

Book entry amount in the configured currency (see Settings). If a tax rate is set, this is considered the gross amount. The net amount in the next field is automatically calculated if you change the gross amount.

In the Journal table the gross amount is always displayed.

Net

If a tax rate is set, the net amount of the book entry is entered here. The gross amount in the previous field is automatically calculated if you change the net amount.

If no tax rate is set, this field is disabled.

More

![]() Custom fields: Here you can define your own fields. See Custom fields.

Custom fields: Here you can define your own fields. See Custom fields.

This is a PRO feature (not available in the free version).

![]() Notes: You can enter arbitrary notes here.

Notes: You can enter arbitrary notes here.

![]() Attachments: You can attach one or multiple files here. See Attachments.

Attachments: You can attach one or multiple files here. See Attachments.