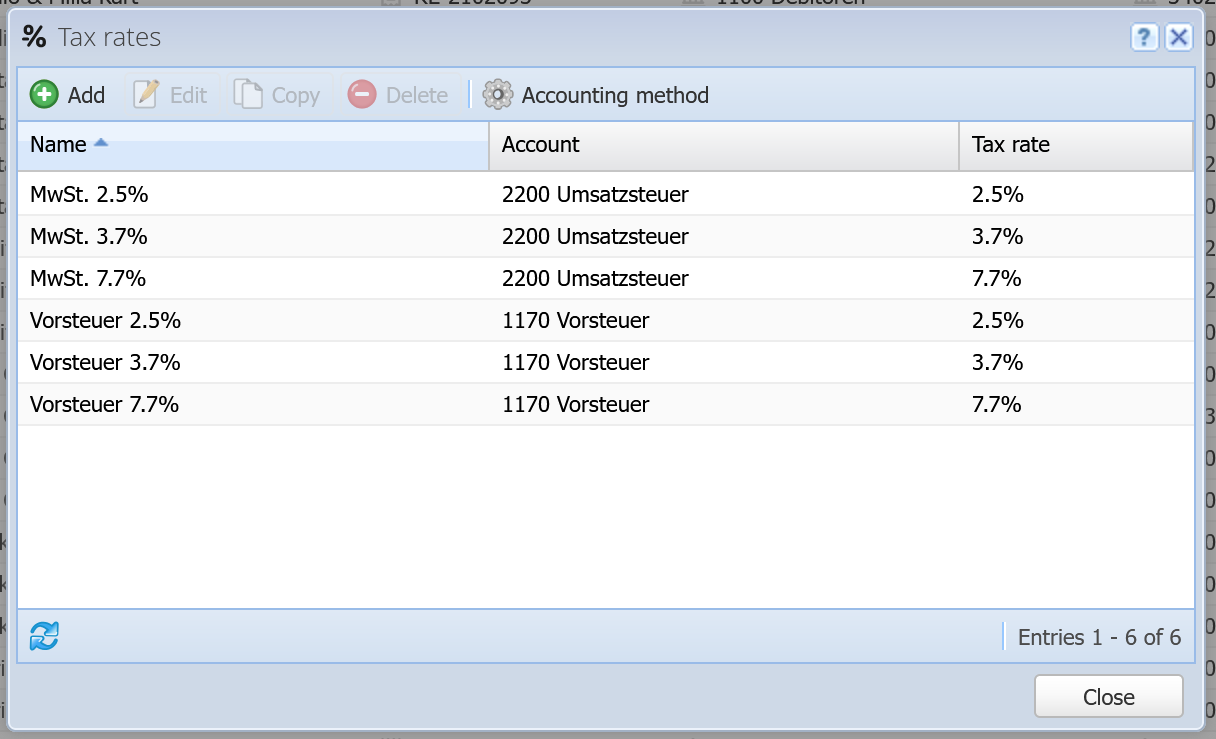

Tax rates

Tax rates are used for the sales tax or value-added-tax (on revenue) and input tax (on expenses).

This is list is pre-populated with the current VAT rates from Switzerland. You can adapt this list however, remove tax rates and add new ones.

Please note that we do not automatically adjust tax rates when they change in Switzerland. In an existing accounting system, the user is responsible for making these adjustments.

Add / Edit / Copy [more]

Hereby you can create a new tax rate resp. edit or copy an existing one.

Delete

Hereby you can delete one or multiple tax rates. Tax rates already in use cannot be deleted. However, you can set them as inactive.

Accounting method [more]

Here you can configure which accounting method is used for orders (agreed or received).